About the Company

Inox Wind Ltd (‘Inox’) is a Gujarat based Wind Energy solutions provider, with end – to – end turnkey capabilities of site infrastructure, supply of equipment, erection testing and commissioning services, and long term operations and maintenance services (‘O&M’).

Inox has in-house annual manufacturing capability of 1,600 MW of Wind Turbine Generators (‘WTG’), through three facilities based in Una, Himachal Pradesh (for hubs and nacelles), Rohika, Gujarat (for blades and towers) and Barwani, Madhya Pradesh (integrated), as well as a land bank inventory of ~5,000 MW in various states in India.

For Nacelles, Inox has an exclusive and perpetual technology agreement with AMSC Austria, a wholly owned subsidiary of energy technology firm American Superconducter Corp., while for Blade Sets, a non-exclusive licensing agreement with Wind Novation Engineering Solutions GmbH, Germany

About the Promoters

Inox Wind Ltd was established by the Ahmedabad, Gujarat, based Jain family in 2009. Other companies in the group, also promoted by the Jain family include:

- Gujarat Fluorochemicals Ltd – India’s largest manufacturer of chloromethanes and refrigerants, established in 1987, with standalone revenues of ~Rs 1,500 Crs in FY17A

- Inox Air Products Ltd – India’s largest producer of industrial gases, a 50:50 JV between the Inox group and Air Products Inc, USA

- Inox Leisure Ltd – India’s second largest multiplex chain, established in 1999, with standalone revenues of Rs 1,150 Crs in FY17A

- Inox India Ltd – India’s largest producer of cryogenic liquid storage and transport tanks

About the Sector – Renewable Energy (Wind)

On 31st March, 2017 India had 32 GW of installed and commissioned Wind Energy capacity, accounting for 10% of its total installed capacity. The current government has a target of installing 175 GW of generation capacity from Renewable Energy sources by 2022, of which 60 GW is to be contributed by Wind Energy.

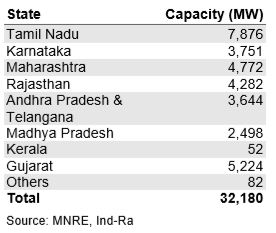

In FY17, India commissioned 5.4 GW of Wind Energy capacity, and is the 4th largest Wind Energy generator in the world after China, the US and Germany. State-wise installed capacity among the 8 windy states is given below

The wind energy market in India is undergoing a structural change, while moving from a Feed in Tariff (‘FIT’) based regime, to an Auction based Competitive Bidding regime with lower tariffs, as explained below.

Feed in Tariff Regime: Under the earlier regime, the Tariff Regulatory Authority of each state specified a fixed per unit purchase price to be paid by the State Distribution Company (‘DISCOM’) to the Independent Power Producer (‘IPP’). These tariffs ranged from Rs 4.16 and Rs 4.19 per unit in high wind states of TN and Gujarat respectively, to Rs 4.78 and Rs 4.84 per unit in MP and AP respectively.

Wind Energy companies like Inox secured all necessary approvals and land banks, supplied equipment as well as installation and commissioning services, to offer a complete turn key project to the IPP. The IPP brought in equity during the period of construction, and tied up debt financing, while signing a long term Power Purchase Agreement (‘PPA’) with the respective DISCOM closer to the date of commissioning and commencement of commercial operations (‘COD’).

In doing so, Wind Energy companies acquired large land banks in areas having maximum potential for generation, for a pipeline of future projects to be marketed to IPPs over the next 2-3 years.

Auction based Competitive Bidding Regime: In February 2017, Solar Energy Corporation of India (‘SECI’) conducted an e-reverse auction for 1,050 MW of Wind Energy generation, with an aim of achieving a centrally discovered lowest rate for procurement of Wind Energy, eliminating abnormal profits accruing to IPPs and Wind Energy companies (due to different FIT rates in different states), while also selling power to non-windy states for their respective Renewable Purchase Obligations (‘RPO’),

The auction realised a discovered price of Rs 3.46 per unit, which was 27% lower than the average FIT rate, and was won by Mytrah Energy, Inox Wind, Ostro Kutch Wind Pvt Ltd, Green Infra (250 MW each) and Adani Green Energy (50 MW). PPAs were signed with PTC India Ltd, the appointed trading company, for back to back sale to DISCOMs of various states – Uttar Pradesh (450 MW), Bihar (200 MW), Jharkhand (200 MW), Delhi (100 MW), Assam (50 MW) and Odisha (50 MW) for meeting their Non-Solar Renewable Purchase Obligation (RPO), to be commissioned by September 2018

Advantages of Auction Regime for IPPs:

- Lower Regulatory Risk: PPAs signed upfront before start of construction v/s PPAs signed closer to commissioning date under FIT regime

- Lower Revenue Risks: Stronger counter-party (PTC India Ltd v/s DISCOMs) with better payment security and backed by SECI

- Assurance of Grid Connectivity with Central Transmission Utilities

- Lean Working Capital Management: with PPA signed upfront, and fixed 18-month period for contract execution leading to efficient planning of supply chain

Advantages of Auction Regime for DISCOMs:

- Ability to purchase power at the lowest possible price (wind and solar energy are now both more economical per unit to purchase than conventional sources of thermal power)

- Eliminating abnormal profit to IPPs through differences in PLF potential at various sites within the same state, under the FIT regime

- Cost of Renewable energy is fixed for the next 25 years, with no dependence on raw material price, and benefits of lower pollution

Following the auction, some states have been unwilling to sign PPAs at existing higher FIT rates and seek to renegotiate rates to lower auction discovered prices. The lower rates may render in-progress projects un-viable, and leave an inventory overhang on the books of Wind Energy service providers.

A combination of the above structural change, as well as expiry of Generation Based Incentive (‘GBI’) benefit of Rs 0.5 per unit for projects commissioned after 31st March 2017, is expected to lower the capacity commissioned in FY18 to 1.0 – 1.5 GW only.

On 4th October 2017, SECI conducted the 2nd round of auctions for Wind Energy generation, for 1 GW of capacity, which established a record low tariff of Rs 2.64/unit, 24% lower than the previous winning bid in February 2017, and 18% lower than the average rate of power generated by coal fuelled power projects of NTPC Ltd.

The auction was won by Renew Power Ventures (250 MW at Rs 2.64/unit); Orange Sironj Wind Power (200 MW at Rs 2.64/unit); Inox Wind Infrastructure Services Ltd (250 MW at Rs 2.65/unit); Green Infra Wind Energy Ltd (250 MW at Rs 2.65/unit) and Adani Green Energy MP Ltd (50 MW at Rs 2.65/unit)

Going forward, the FIT regime is projected to be phased out, with each state moving to Auction based Competitive Bidding model. Each state is also expected to launch auctions for incremental capacity, along with PSUs and Companies looking for captive capacity. The tariff quotes for future auctions will be governed by each auction’s structural features such as state guarantee, counter party’s credit quality, offtake risks and capital cost dynamics.

Inox competes with other Wind Energy companies such as Suzlon Energy Ltd, Gamesa Wind Turbines Lvt Ltd, Vestas, Wind World India Ltd and Regen Powertech in this sector.

Operational Performance

As on 31st March 2017, Inox had a cumulative WTG install base of ~2,200 MW (7% of total Wind Energy Projects commissioned in India), of which 656 MW (~30%) was commissioned in FY17, and 1,866 MW (~85%) has been commissioned in the last 4 years.

Inox currently offers 2 MW WTGs in 93.3m, 100m and 113m rotor diameters, and installation capabilities at hub heights of 80m, 92m and 120m, allowing it to cater to medium and low wind areas. It also has a 3 MW WTG under development.

Financial Performance (Consolidated)

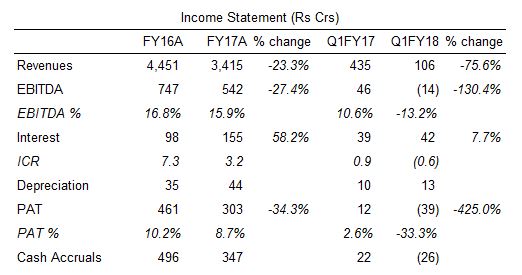

Revenues for FY17A decreased by 23% from Rs 4,450 Crs to Rs 3,415 Crs, due to a decline in sales volume from 826 MW to 522 MW. Inox commissioned 656 MW of capacity in the year, from 786 MW in FY16, majorly affected by the stoppage of PPA signing by DISCOMs post SECI auctions in February 2017.

As per the management discussion, Inox discontinued production of new WTGs on stoppage of PPA signing by state DISCOMs. It has tried to address the situation by re-routing WTGs from states where PPAs were refused to be signed, to projects where PPAs were signed and in place, and from private IPPs to PSU contracts, where PPA signing is not an impediment to commissioning turbines and collecting payments.

In Q1FY18, with the continuing downturn in the sector due to movement from FIT regime to Auction regime, Inox had revenues of only Rs 106 Crs, a 75% decline over the PY, with EBITDA loss of Rs 14 Crs and net loss of Rs 39 Crs. It commissioned 46 MW of WTGs in the quarter. The management expects recovery only in the second half of FY18, and FY19 thereafter.

The stoppage in PPA signing resulted in several under-construction projects held in stasis until further clarity emerges, with a lot of WTGs either on the ground at project sites, or installed but unable to be commissioned.

Although legally and contractually, Inox’s customers are bound to pay as getting PPAs signed is not Inox’s responsibility, in the practical world, the customer keeps the balance amount outstanding until PPA is signed, and WTGs are commissioned and generating billable energy.

The Asset Conversion Cycle for Inox deteriorated as a result. Inventory days ballooned from 75 in FY16 to 131 in FY17, Receivables ageing increased from 198 to 255 days, while Payable ageing was held constant at 4 months.

To fund this inventory, Inox was compelled to divert Rs 170 Crs from IPO proceeds (initially meant for Expansion of Manufacturing Facilities and Investment in Subsidiaries) towards Long Term Working Capital Management in July 2017, and necessitated higher short term debt utilisation.

As per management estimates, a large part of this inventory and receivables position is expected to move and be cleared over the course of the current financial year. There are no write-offs projected.

Over the course of Q1FY18, Inox faced further hurdles in the form of financers, due to the turmoil in the sector, unwilling to disburse funds to IPPs, and onwards to Inox, as well as excessive rains in Gujarat which led to a slowdown in execution for PSU projects (NTPC Ltd and SJVNL)

Share Price Performance (BSE: 539083 | NSE: INOXWIND)

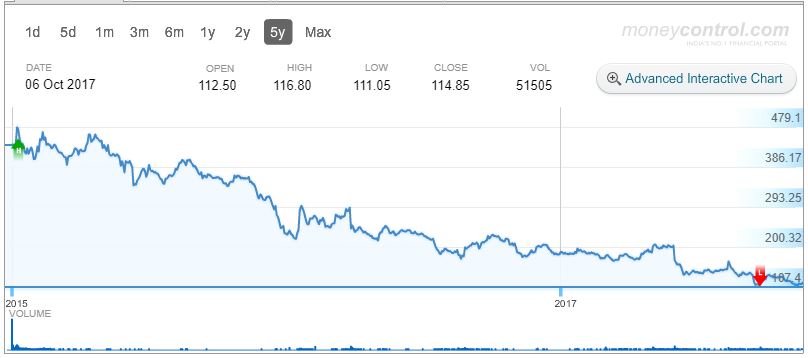

Inox Wind listed on the stock markets on 9th April, 2015 with a fresh issue of Rs 700 Crs, and Offer for Sale of Rs 320 Crs, at a price of Rs 325 per share. The IPO was oversubscribed 18x times, and rose 34% on the day of listing to close at Rs 438.

Thereafter, it has seen massive value erosion for investors, declining 75% over the last 2 years, and closed at Rs 114 on 6th October 2017, due to the uncertainty in the industry and fluctuating revenues and margins on movement from the FIT to Auction based regime, as can be seen from the charts below.

Future Outlook

Winning Bids under Auction Regime with back to back Sell-down to IPPs: Under the new Auction based Competitive bidding regime, Inox secured 500 MW of projects (25% of total 2 GW auctioned) and plans to have back-to-back arrangements with IPPs for selling down the projects i.e. IPPs will be investing in SPVs created by Inox for the tenders, and Inox will exit the SPV on commissioning. The management does not project any difficulties in this aspect, as bidding was for ~4 times the capacity auctioned and demand exceeds supply in this case.

Diminished Order Book, with Healthy Prospects: At an approximate cost of Rs 6 Cr per MW (Management Assumption, Q1FY18 Conference Call) Inox has an order book of Rs 3,000 Crs of project execution from SECI auctions alone, to be executed over the course of FY18 and FY19, with further scope of state as well as PSU auctions, combined with tie-up for equipment supply and installation for other winners of the auctions conducted, and O&M Services contract revenues for installed and to be installed WTGs. Although their current order book stands diminished due to the stoppage of PPA signing by various DISCOMs in Q4FY17, the drastic drop in Q1FY18 revenues is expected to be a temporary phenomenon.

Growing Contribution from High Margin O&M Revenues: Traditionally, WTG supply contracts are also accompanied with 10 to 12 year Operations and Maintenance (‘O&M’) contracts with suppliers, of which the first 2 to 3 years are free service period. Revenues from these contracts are steady and non-cyclical in nature. In FY17, O&M Services contributed only 3% to Inox revenues, but given the majority of installations for Inox occurred over the last three years, a large install base is expected to migrate from free warranty to paid servicing in FY18 and FY19, supporting revenues as well as margins for the firm.

Manufacturing Capabilities: With the commissioning of their Madhya Pradesh facility, Inox has doubled its Blade manufacturing capacity, and aligned it with Hub and Nacelle capacity. While Tower manufacturing capacity was also enhanced, they are a fairly low technology item, which can also be outsourced.

Thus, Inox is well placed for catering to future market demand. Despite having undergone capex, Inox is relatively comfortably leveraged, with gearing net of unencumbered cash at 1.16x for FY17.

Verdict

ACCUMULATE at current levels.

Disclosure

The author holds small (less than 1% of portfolio) long positions in Inox Wind Ltd

Sources

- Inox Wind Ltd – Website

- Inox Wind Ltd – Investors Section

- IndiaRatings – Special Report – Infrastructure and Project Finance

- Ministry of New and Renewable Energy, GoI – Annual Report

- Share Price Graphs – via Moneycontrol.com

- Other Sources – Hyperlinked in the article above